Protect today. Thrive tomorrow.

Take control of your digital life with Allstate Identity Protection.

Advanced family protection**

Our generous definition of family covers everyone “under roof and under wallet,” and now with a Pro+ plan includes relatives 65+, regardless of where they live.

Enhanced financial protection

From detecting threats to your finances and credit to reimbursing funds† stolen from your bank account, 401(k)s, HSAs, and more, we’ll help you secure a brighter future.

Fraud remediation and restoration

Our expert team is highly trained and certified to handle and remediate every type of identity fraud case, helping you and your family save time, money, and stress.

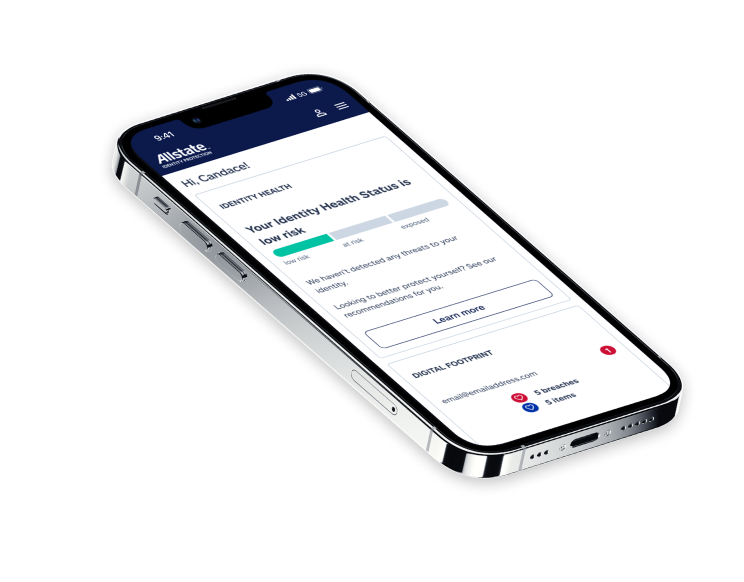

Comprehensive identity monitoring

We provide advanced monitoring and near real-time alerts to help detect threats to your identity and finances — so you can protect what you’ve worked so hard to build.

Getting started is easy

Set up your account

Log in through your portal to complete account setup.

Activate key features

Explore Allstate Identity Protection and fully activate important features like credit monitoring.

Let us take care of the rest

If we detect anything suspicious with your personal and financial information, we’ll send an alert.

Explore our content and resource centers

Your guide for the tools you need.

Content Hub

Fraud trends, privacy insights, and security best practices.

Elder Fraud Center

Self-guided tools and resources for families fighting elder fraud.

Unemployment Fraud Center

Tools and support to help resolve unemployment fraud.

Digital Safety Center for Families

Tips and resources to help protect your loved ones.